Sealaska will distribute $17.5 million in dividends to its 22,000 shareholders on Dec. 3.

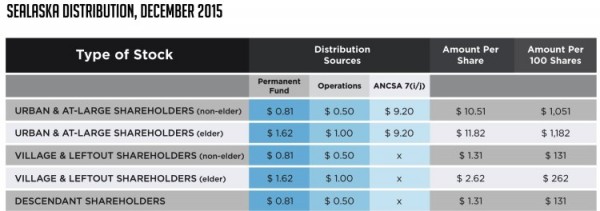

More than 60 percent will receive $1,050. Most of the rest will get around $130.

The difference is a payout from a statewide pool of other regional Native corporations’ resource earnings. Urban shareholders get it directly, but village and new shareholders don’t.

The dividends are mostly funded by other regional Native corporations’ resource earnings, though officials at the Juneau-based corporation said that will change. Sealaska CEO Anthony Mallott said the pool, known as 7(i), is expected to shrink.

“The 7(i) income we receive is very tied to commodity pricing. And the two main commodity prices that affect the 7(i) we see is oil prices and zinc prices. And both of them have been pretty significantly hit in this recent commodity price decline,” Mallott said

About 8 percent of the larger dividends come from Sealaska’s permanent fund. Around 5 percent comes from operations, which sounds like the corporation’s own earnings. But at this point, Mallott said most of that money also comes from the resource earnings pool.

Sealaska has been trying to bounce back from a $57 million operational loss since 2013.

The recovery plan is to buy a controlling interest in one or several seafood, government services or other businesses with growth potential.

“Putting our investment capital to work is going to be one of the only significant solutions to deal with any decline in 7(i). We understand that pressure, but we still want to keep to a process where we are comfortable that we’re making the right decision,” he said.

Mallott said Sealaska continues researching potential purchases. He said it’s negotiating with about a half-dozen companies, though he didn’t say what they are.

Ed Schoenfeld is Regional News Director for CoastAlaska, a consortium of public radio stations in Ketchikan, Juneau, Sitka, Petersburg and Wrangell.

He primarily covers Southeast Alaska regional topics, including the state ferry system, transboundary mining, the Tongass National Forest and Native corporations and issues.

He has also worked as a manager, editor and reporter for the Juneau Empire newspaper and Juneau public radio station KTOO. He’s also reported for commercial station KINY in Juneau and public stations KPFA in Berkley, WYSO in Yellow Springs, Ohio, and WUHY in Philadelphia. He’s lived in Alaska since 1979 and is a contributor to Alaska Public Radio Network newscasts, the Northwest (Public Radio) News Network and National Native News. He is a board member of the Alaska Press Club. Originally from Cleveland, Ohio, he lives in Douglas.