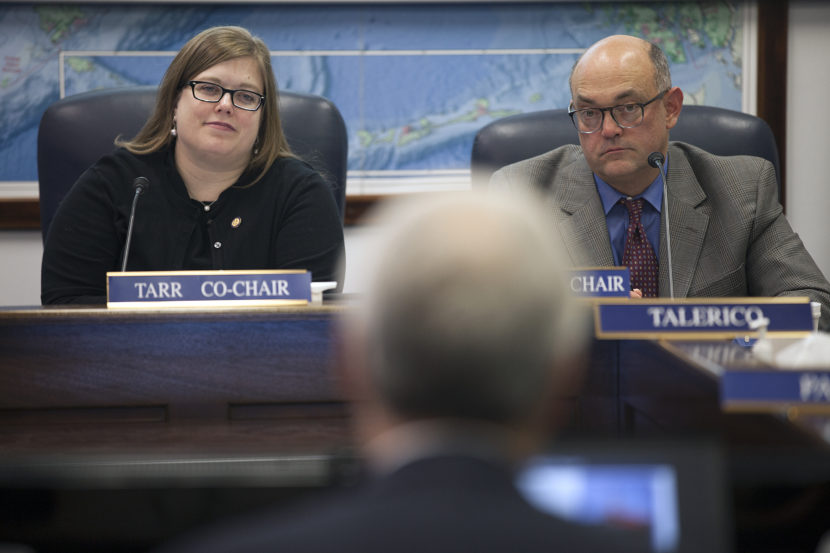

A state House committee heard testimony Wednesday afternoon from the big three North Slope oil producers. ConocoPhillips, ExxonMobil, and BP representatives gave several members of the House Resources Committee their perspectives on how the state’s oil tax structure is working.

Alaska’s current tax regime on the North Slope essentially takes 35 percent of the profit a company earns on a barrel of oil, but tax credits reduce the amount companies actually have to pay.

While each company represents different finds in different areas of the North Slope with different profit margins, they had a similar message:

“The need for Alaska to maintain a competitive fiscal regime that encourages critical, ongoing and long term investment is by far one of the most important issues you face,” ExxonMobil Tax Counsel Dan Seckers said. “We know it’s going to be tough for you and the entire legislature to deal with this issue.”

Seckers and others told lawmakers that its current tax regime, the More Alaska Production Act (MAPA) is working.

“Has MAPA made Alaska’s investment climate more competitive? Has it resulted in more simple, predictable production taxes? Has it been working as legislators had hoped? Has it lived up to its name? We believe, at ExxonMobil the answer to each and every one of those questions is yes,” Seckers said.

The committee heard three hours of testimony.

Lawmakers are gearing up for a tough session as they negotiate how the state will fill its multi-billion dollar budget hole. How the oil and gas industry should help fill that hole is a particularly complicated question.

Kara Moriarty, President of the Alaska Oil and Gas Association, told the committee that the tax credits are working to generate new development and investment. But she also reminded lawmakers that the state has changed its tax policies six times in the last decade.

“How can we remain competitive when the state has constantly changing tax policies?” Moriarty asked.

The industry representatives repeatedly told the state that they want a stable tax regime.

The committee will also hear presentations from some of the state’s smaller oil companies as House lawmakers work toward introducing a bill that could again tweak the state’s tax structure.

Rashah McChesney is a photojournalist turned radio journalist who has been telling stories in Alaska since 2012. Before joining Alaska's Energy Desk , she worked at Kenai's Peninsula Clarion and the Juneau bureau of the Associated Press. She is a graduate of Iowa State University's Greenlee Journalism School and has worked in public television, newspapers and now radio, all in the quest to become the Swiss Army knife of storytellers.