Alaskans are voting whether to allow the state to issue debt to lower the interest students pay for college loans.

If voters amend the Alaska Constitution through Ballot Question No. 2, more students may be able to borrow to pay for college.

The Alaska Student Loan Corporation lends money to Alaskans to go to college. But the number of students who receive these loans has dropped steeply. That’s in part because fewer students can afford the interest on those loans, as well as the fact that fewer students qualified for loans after the state raised its credit standards.

While the corporation was started by the state, it has to pay more to bond holders than the state government does. That’s because the loan corporation’s bond rating isn’t as high as the state’s.

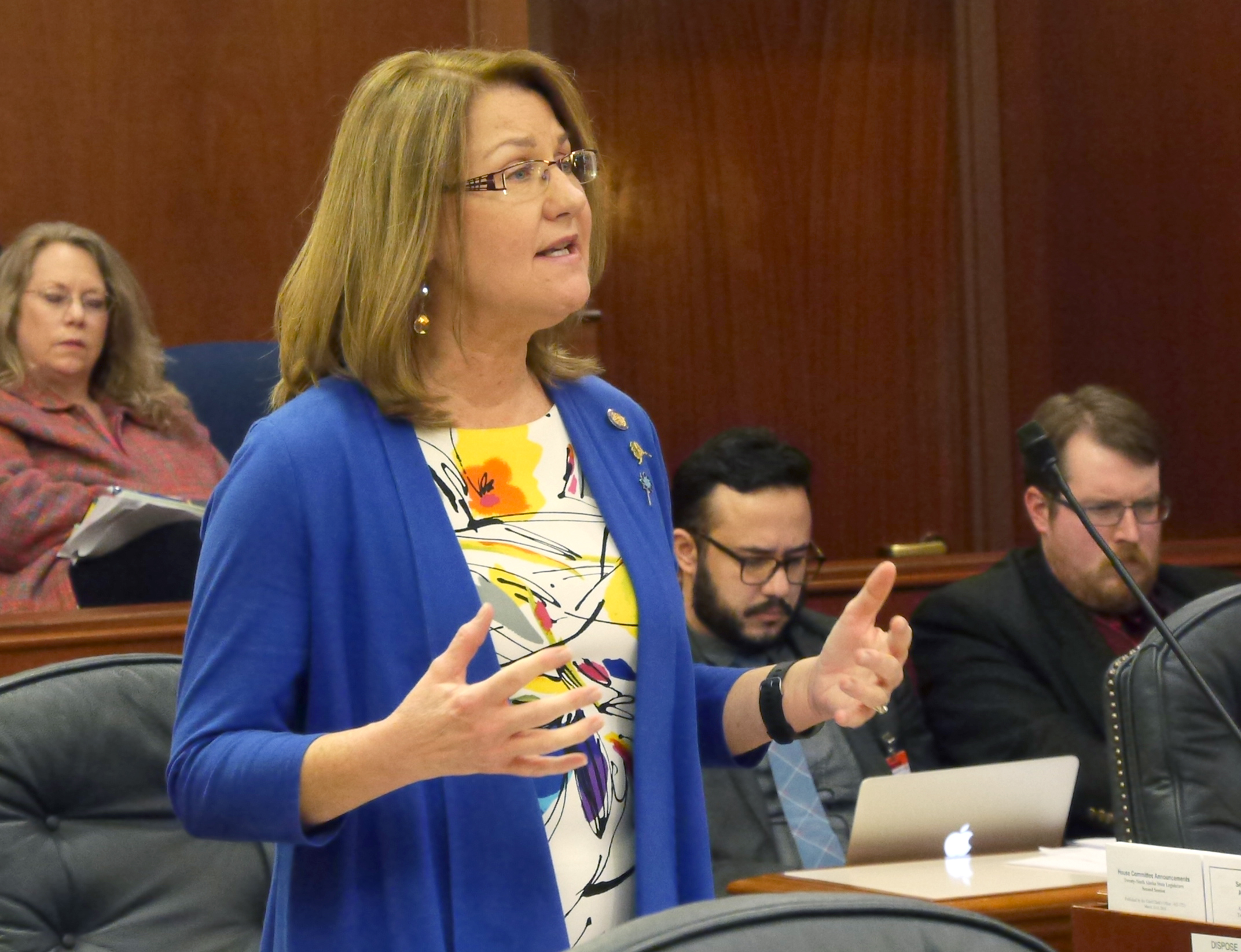

Eagle River Republican Sen. Anna MacKinnon sponsored the ballot question that could eliminate the difference.

“My primary purpose is: How can we do something at no cost to the state of Alaska that would help students that are carrying an incredible amount of debt,” MacKinnon said.

In April, corporation leaders projected the student loans could have an interest rate roughly one percent lower if the state issued bonds to back loans, instead of the corporation. That would save a student with the average amount of loans ($20,000) almost $1,200 over 10 years. The actually savings may be smaller, because the state’s credit rating has fallen since the estimates were made.

The state constitution limits state general obligation bonds to capital projects, veterans’ housing, and emergencies. If enacted, the amendment would allow the legislature to seek voter approval for bonds to back current and future student loans.

Former corporation executive Diane Barrans told legislators earlier this year the measure could also allow more students to borrow, because their credit scores wouldn’t have to be as high as they are now.

“We have about 40 percent of the applicants who do not qualify and are unable to get a cosigner,” Barrens said.

Not everyone supports the amendment. Former state Revenue Commissioner Sterling Gallagher said college loans are too risky for the state to use its own bonds, since many students don’t pay off their loans.

“If we want to lower the credit ratings on student loans, let’s do it based on known cash flows, not on some grab of the state’s general credit,” Gallagher said.

MacKinnon countered that the state already faces the risk of paying off student loans in default, but students don’t benefit from the state’s higher bond rating.

“The risk that is there today is pretty much the same risk that would be there tomorrow if voters voted yes,” MacKinnon said.

Only two lawmakers – Sitka Republican Senator Bert Stedman and Wasilla Republican Representative Lynn Gattis – voted against the legislation putting the question on the ballot.

Andrew Kitchenman is the state government and politics reporter for Alaska Public Media and KTOO in Juneau. Reach him at akitchenman@alaskapublic.org.