A Republican bill to repeal and replace parts of the Affordable Care Act is advancing in the U.S. House. It would end the tax penalty for going uninsured and lift regulatory burdens on employers. But its effects across the country are uneven. Here are three things an Alaskan should know about the proposed American Health Care Act.

1. Alaskans would be the biggest losers of tax credits.

“Alaska is the most extreme example in the country of a more general problem with the House Republican tax credits approach,” Aviva Aron-Dine said. She worked on health care in the Obama Administration. In a report for the Center on Budget and Policy Priorities, she made Alaska the poster child to show how the Republican plan shrinks tax credits in some states more than others. (CBPP is non-partisan but often described as liberal or left-leaning.)

Under the Affordable Care Act, the average Alaskan who buys a policy on healthcare.gov receives a tax credit – a subsidy – of about $13,000 a year. That’s by far the highest in the country, intended to offset the highest premiums in the country.

Under the Republican bill, the tax credits vary only by age, not by location or income (although they begin to taper for people who earn $75,000 and up). That means the average Alaskan marketplace customer would see a tax credit of less than $3,000, a drop of 78 percent.

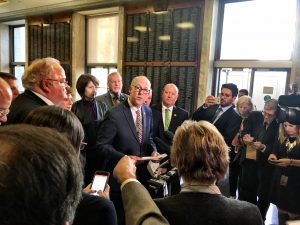

House Energy and Commerce Committee Chairman Greg Walden said the bill his committee just passed can’t do everything. It has a limited scope so it can pass in the Senate under rules that require only 51 votes instead of the usual 60. But Walden said the health secretary has levers to pull that could lower premiums in high-cost areas.

“There’s a whole other opportunity under Sec. Price to make market changes that he can’t share ahead of time, by law, but I think he will make, that will have an impact,” said Walden, R-Ore.

2. The Republican plan would change the way Medicaid is funded.

Now, the feds and the states share the cost of program that helps poor people, based on actual costs. In 2020, the Republican bill would start paying states per capita for their Medicaid patients. The payment is tied to what they paid in 2016. Alaska spent a lot, so its per capita payment could be about double what a low-cost state like Alabama would get. The payments would grow over time, but if Medicaid costs grow faster, states would have to shoulder more of the tab.

And there’s reason to believe Alaska’s per capita Medicaid costs could go up, because its population of low-income elderly is growing faster than almost anywhere in the country. These are the more expensive Medicaid patients.

3. Alaska employers are not escaping the Cadillac tax.

That’s a feature of the Affordable Care Act that would hit employers who provide high-cost plans for their workers, plans that cost more than $10,200 per person ($27,500 for families) per year.

But in Alaska it’s more of a Subaru tax, because plans just cost more. A lot of Alaska employers provide plans that meet that threshold, or will in the coming years.

Under existing law, the Cadillac tax is due to take effect in 2020. The Republican bill keeps the tax but pushes the start date to 2025.

That’s just 3 things. There’s a lot more to digest in the Republican health care bill. Alaska’s members of Congress say they’re still studying it.

Liz Ruskin is the Washington, D.C., correspondent at Alaska Public Media. Reach her at lruskin@alaskapublic.org. Read more about Liz here.