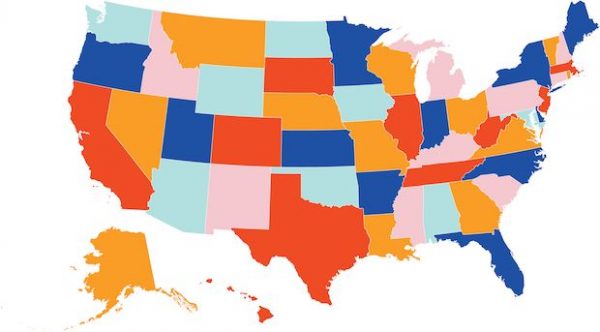

No state fared worse than Alaska in receiving COVID-19 disaster loans from the Small Business Administration. A Bloomberg News reporter crunched the numbers and discovered an important correlation:

“What we found was that a handful of states, about a dozen states, that were the earliest states to request a disaster declaration got this outsized share of all the money,” said Bloomberg’s Zachary Mider, a reporter in New Jersey.

Just one Alaska company got an Economic Injury Disaster Loan, according to early federal data on the program.

Alaska Gov. Mike Dunleavy declared a state disaster on March 11. But, like most states, Alaska’s request for federal disaster status did not come in until March 17. About a dozen states applied earlier and a dozen applied later, Bloomberg found.

When the money actually started flowing, every state had a federal disaster declared, but by then, Mider said, states like Alaska were already stuck in a queue.

“And so, even a month later, the money that’s flowing out of the SBA is disproportionately favoring these kind of early requesters, these states that were the first to qualify for the program,” Mider said.

Connecticut, Nevada, Washington state and Washington, D.C. fared well. The SBA awarded more than 20 loans per 10,000 small businesses there, Bloomberg News reports. For Alaska, with one successful applicant, the rate comes to 0.1 loan per 10,000 businesses.

Mider said the pattern holds if you look at loan value per capita — the early requestor states got more money. The loan totals going to businesses in early-requestor states come to $20 or more per capita. Alaska’s one loan for $500,000 breaks down to just 68 cents per capita.

The dates may explain why Alaska did not do well in disaster loans, but it doesn’t entirely explain why the state did so poorly. Alaska got less, in loan numbers and value, than every other state, including low-population states and those whose governors did not request disaster status until two days after Alaska did.

U.S. Sen. Dan Sullivan said Wednesday he’s trying to get answers from the SBA to ensure the pattern doesn’t repeat.

The initial data on the program does not cover all the disaster loans granted in the first batch, so it is likely that other Alaska businesses have been awarded EIDL loans already.

Congress added $60 billion to the Disaster Loan program on Thursday.

READ: States that asked first got the most coronavirus disaster relief

Liz Ruskin is the Washington, D.C., correspondent at Alaska Public Media. Reach her at lruskin@alaskapublic.org. Read more about Liz here.