Alaska’s state-owned economic development corporation can now spend up to $20 million to buy oil leases in the Arctic National Wildlife Refuge’s coastal plain.

The board of the Alaska Industrial Development and Export Authority unanimously approved the spending Wednesday night.

“I believe resource development is our future,” said AIDEA board member Albert Fogle. “A stronger resource development industry will trickle down into the other industries.”

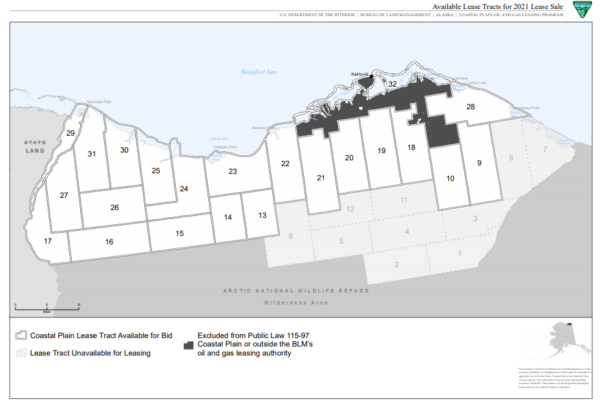

It’s up to AIDEA’s director, Alan Weitzner, to decide which pieces of land to bid on in the Trump administration’s lease sale on Jan. 6.

The idea is that, if AIDEA wins the tracts, it could partner with companies to do the actual drilling.

It’s a way for the state to make sure the land is set aside for oil development in case no one else bids on the leases. Environmental organizations and some tribal groups have been campaigning for oil companies, banks and other financial institutions to stay away from developing the refuge.

Weitzner said he wasn’t aware of the corporation submitting bids for federal oil and gas leases in the past.

It’s a controversial move.

‘A ticket to decades of litigation’

Public comment at Wednesday’s meeting was dominated by people who opposed AIDEA bidding on the leases in the Arctic refuge.

Some cited concerns about drilling’s impact on the global climate and on wildlife in the coastal plain, including polar bears and caribou.

“The Arctic refuge is a majestic landscape on which people and animals alike depend,” said Karlin Itchoak, Alaska state director for The Wilderness Society.

RELATED: The Trump administration is moving to sell leases in ANWR, but will anyone show up for a sale?

Some asked: Why not put the $20 million toward diversifying Alaska’s economy instead?

“You are trying to patch a declining industry that the state of Alaska is already way too heavily invested in,” said Julian Dan, a graduate student at the University of Alaska Fairbanks.

Matthew Jackson, from Ketchikan, described AIDEA buying leases as “a ticket to decades of litigation.” It’d bring the state a lot of risk, some said.

Others said if oil companies really want to drill in the refuge, they’ll buy the leases themselves.

Diane Preston, from Fairbanks, was among many who blasted AIDEA for not providing more time for Alaskans to weigh in on whether it should spend money on oil leases.

The corporation posted the text of the proposal to bid just two days before the meeting.

“I think it’s pretty unconscionable to have a short few days’ process for public comments on such an important issue, particularly during the pandemic and holiday week,” Preston said.

“I don’t think that speaks well for you … those of you who thought you could do this kind of under the radar.”

The board accepted emailed comments this week, and said it got more than 300.

It set aside 90 minutes for public comments by phone on Wednesday. Then it went into a two-hour, private executive session.

‘You need more production. You need more leases.’

Shortly before 8 p.m., the public meeting resumed.

Board member Anna MacKinnon, a former state legislator, defended AIDEA’s timeline.

She said the federal Bureau of Land Management didn’t post the details of the coastal plain lease sale until early December.

And in the days following, she said, conversations ramped up about AIDEA bidding on the leases because of opinion columns written by former Alaska Govs. Bill Walker and Frank Murkowski.

At Wednesday’s meeting, Murkowski told board members that the state has an “extraordinary opportunity” to buy the leases because, he argued, they’d basically be 50% off. The state gets half of the lease-sale revenue.

“The future of the state, from the standpoint of oil production, is more production,” he said. “You need more production. You need more leases.”

RELATED: The lease sale is set, but how much oil actually is under ANWR’s coastal plain?

Murkowski has long supported opening the coastal plain to oil development, and his daughter, U.S. Sen. Lisa Murkowski, spearheaded the provision in a 2017 tax act to allow drilling there, reversing decades of protections.

Board members said ensuring oil development happens is good for the economy.

Board Chair Dana Pruhs said approving the money for the leases is also a way to protect “the sovereign rights of the state” and “40 years of everybody’s efforts to open up the coastal plain in ANWR.”

If a tract doesn’t get any bids in next month’s lease sale, then the federal government maintains control of it. And two weeks after the sale, President-elect Joe Biden takes office. Biden has said he opposes drilling in the refuge, and that he’ll take steps to permanently protect the land.

When crafting its bids, Pruhs said, AIDEA should consult with anyone with expertise in federal oil leasing, including the state Department of Natural Resources.

The $20 million will come from the corporation’s Arctic Infrastructure Development Fund, created by the state Legislature.

The board did not discuss Wednesday where the corporation might bid, and how many pieces of land it might want.

Weitzner has until 4 p.m. next Thursday to decide. That’s the deadline to submit any sealed bids to the Bureau of Land Management.

The federal government will open all of the offers on Jan. 6 and award the leases to the highest qualified bidders.

But two major uncertainties still loom.

Groups opposed to drilling have asked a federal judge to step in and block the upcoming sale. A ruling is expected by Jan. 6.

Also, the Anchorage Daily News reported, Wednesday’s vote by the board could be challenged because of unconfirmed appointees.

RELATED: Alaska Legislature will sue Gov. Mike Dunleavy over lapsed appointments

Reach reporter Tegan Hanlon at thanlon@alaskapublic.org or 907-550-8447.