Local governments in Alaska that charge a sales tax could have millions of dollars less in revenue this year.

That’s because their residents will have less money to spend than the last few years because of lower Permanent Fund dividends this fall.

Some municipalities, like the City and Borough of Juneau, are preparing for the indirect hit.

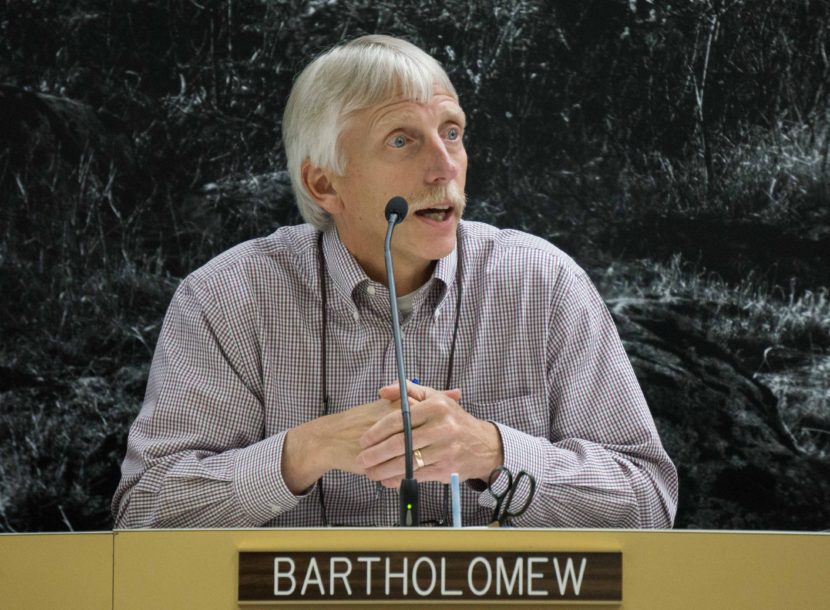

Juneau finance director Bob Bartholomew projected Gov. Bill Walker’s dividend reduction of about half will cost the city.

“We had estimated that the reduction of the dividend from $2,000 per person to $1,000 per person would cost us … at the high end about a million dollars of lost sales tax revenue,” Bartholomew said.

That’s out of $44 million of total sales tax revenue that the city projected.

Juneau is one of 107 municipalities in the state that collects sales taxes. These communities raised a total of $233 million in sales tax revenue two years ago. So, if Bartholomew’s projections are applied to the entire state, then there would be $4 million to $5 million less coming in.

Bartholomew said it’s challenging to estimate how much less money residents will spend. In part, that’s because having less money to spend could lead residents’ behavior to change.

“It could have a ripple effect of just overall reduction in spending that exceeds the pure loss of dollars, just because of the overall just psychological impact on spending,” he said.

Walker has said the dividend reduction was necessary in order to shore up the state’s finances in the long run. Without the cut, Walker said PFDs could disappear entirely in two years, as the state exhausts Permanent Fund earnings.

Each municipality is handling the sales tax effect in its own way.

Kenai Peninsula Borough Mayor Mike Navarre said the borough has never analyzed how residents spend their dividends.

The borough based its projection for sales tax revenue on last year’s spending, and hasn’t made adjustments based on the veto.

“Sometimes it’s difficult to predict exactly what the impacts are going to be,” Navarre said. “In this case … we have proximity to Anchorage, so some people will buy bigger items in Anchorage because they don’t have sales tax, or because they’re going up there to shop anyway.”

Navarre has a separate concern about how the PFD cut will affect tax revenue.

The borough set its property tax due date to occur after residents receive dividend checks.

Navarre said borough officials will be keeping a close eye on whether residents will struggle to pay their taxes on time if they have less money because of lower dividends.

Other municipalities are taking a wait-and-see approach to falling sales tax revenue.

In Unalaska, city manager Dave Martinson said he has looked at the issue, but decided against lowering the city’s revenue estimates.

“We’re going to take an approach that says we will watch it as we go through the year, to determine whether or not there is something we would need to take to our council,” Martinson said.

Municipal governments were affected by other changes Walker made in his late-June vetoes.

He also cut state payments for schools’ debt, transportation and other funding.

Andrew Kitchenman is the state government and politics reporter for Alaska Public Media and KTOO in Juneau. Reach him at akitchenman@alaskapublic.org.