A measure introduced in the Assembly last night will put a potential tax on alcohol before voters this April.

Assembly Chairman Dick Traini introduced the proposal, which could use tax revenues to cover the municipality’s costs connected with drinking.

“What we want to do is dedicate the fund-stream,” Traini explained after the meeting, “to police, to fire, to paramedics, to Health and Human Services, because we have a severe alcohol problem in Anchorage. And we can’t expect Juneau to bail us out of our problem in this town, because they don’t have the money to do it. We need to tax ourselves to take care of the alcohol problem.”

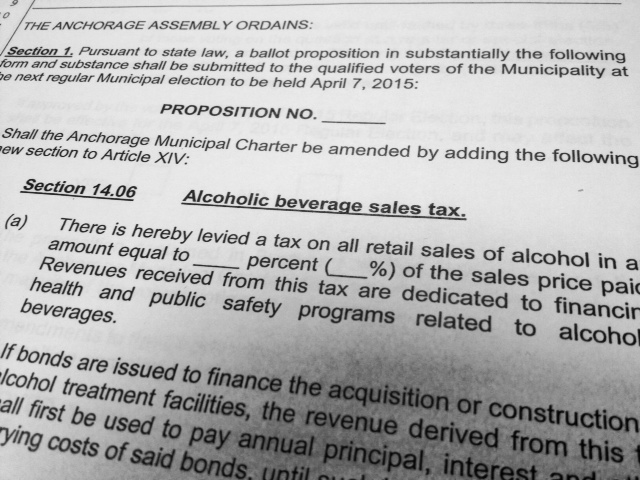

Many specifics have yet to be figured out. For example, the tax rate itself is left blank in the proposal. The Assembly’s finance committee will assess what revenues can be expected from different options, ranging from around three to eight percent.

The Committee on Public Safety is all set to discuss at the measure. As is an ad hoc committee headed by Assembly member Bill Evans that is tasked with looking into connections between homelessness and substance abuse.

Traini stressed that funds will help address the shortage of treatment options like detox centers in Anchorage. “There’s so many times people say ‘Hey, I wanna get off alcohol,'” he explained. “The problem is right now we don’t have the beds for it.”

Anchorage voters will decide whether or not to adopt the law. Public testimony on the matter is scheduled for January 27th and February 3rd. Municipal elections are April 7th.

Zachariah Hughes reports on city & state politics, arts & culture, drugs, and military affairs in Anchorage and South Central Alaska.

@ZachHughesAK About Zachariah